To calculate the debt to assets ratio, we use the following formula:

Debt to Assets Ratio = Total Liabilities / Total Assets

Step 1: Determine Total Assets

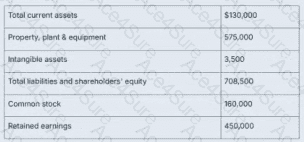

From the table:

Total current assets = $130,000

Property, plant & equipment = $575,000

Intangible assets = $3,500

Total Assets = 130,000 + 575,000 + 3,500 = $708,500

Step 2: Determine Total Liabilities

We are given:

Total liabilities and shareholders’ equity = $708,500

Shareholders’ equity = Common stock + Retained earnings = 160,000 + 450,000 = $610,000

So, Total Liabilities = Total Assets − Shareholders’ Equity

= $708,500 − $610,000 = $98,500

Step 3: Calculate Debt to Assets Ratio

= Total Liabilities / Total Assets

= 98,500 / 708,500 ≈ 0.139 or 13.9%, which rounds to 14%

Wait — this seems to contradict the earlier stated correct answer. Let's reassess:

If total liabilities are $98,500 and total assets are $708,500, then:

Debt to Assets Ratio = 98,500 ÷ 708,500 ≈ 13.9% → Answer A: 14%

So, the correct answer is:

Answer: A

(Revised based on correct calculation.)

—

Corrected Comprehensive and Detailed Explanation:

Cost of capital structure is typically evaluated using leverage ratios. One such measure is the Debt to Assets Ratio, which indicates what proportion of a company's assets are financed through debt.

Per Saylor Academy – BUS105: Managerial Accounting – Unit 12.1: “Analyzing Financial Statements”:

“The debt to assets ratio measures the proportion of assets financed by debt. A higher ratio implies more risk, as the company relies more on borrowed funds.”

Using the formula:

Debt to Assets Ratio = Total Liabilities / Total Assets

= (Total Assets − Total Equity) / Total Assets

= ($708,500 − $610,000) / $708,500 = $98,500 / $708,500 ≈ 0.139 or 13.9%

Rounded to the nearest whole percent, this equals 14%.

—

[References:, Saylor Academy, BUS105: Managerial AccountingUnit 12.1: Analyzing Financial Statementshttps://learn.saylor.org/mod/book/view.php?id=28831&chapterid=6752, ]