CIMA P2 Question Answer

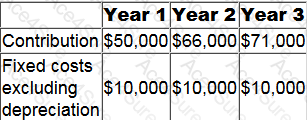

The following forecast data relate to the first three years of a five year project.

The project will require an initial investment of $30,000 in non-current assets.

All revenue will be received in the year it is earned and all operating costs will be paid in the year they are incurred. Tax will be paid in the following year.

Tax depreciation will be 25% per annum of the reducing balance.

The taxation rate will be 30% of taxable profits.

What is the forecast after tax cash flow for year 3 (to the nearest $10)?