Evaluation of Debt Funding vs. Equity Funding for XYZ’s Expansion

Introduction

As XYZ, a successfulcake manufacturer, plans to expand intoadditional confectionery items, it requires significant investment ina new manufacturing facility, machinery, and staff. To finance this expansion, the company must choose between:

Debt Funding– Borrowing from banks or financial institutions.

Equity Funding– Raising capital by selling shares to investors.

Each funding option hasadvantages and disadvantagesthat impactfinancial stability, ownership control, and long-term business strategy.

1. Debt Funding????(Loans, Bonds, or Credit Facilities)

Definition

Debt funding involvesborrowing moneyfrom banks, lenders, or issuing corporate bonds, which must be repaid with interest.

✅Key Characteristics:

The company retainsfull ownership and decision-making control.

Loan repayments are fixed and predictable.

Interest payments aretax-deductible.

????Example:XYZ takes abank loan of £2 millionto purchase new machinery and repay it over five years with interest.

Advantages of Debt Funding

✔Ownership Retention– XYZ keeps full control over business decisions.✔Predictable Repayment Plan– Fixed monthly payments make financial planning easier.✔Tax Benefits– Interest paymentsreduce taxable income.✔Shorter-Term Obligation– Once the loan is repaid, there are no further obligations.

Disadvantages of Debt Funding

❌Repayment Pressure– Regular repaymentsincrease financial riskduring slow sales periods.❌Interest Costs– High-interest rates canreduce profitability.❌Collateral Requirement– Lenders may requirecompany assets as security.❌Credit Risk– If XYZ fails to repay, it riskslosing assets or damaging credit ratings.

????Best for:Companies that want tomaintain ownership and have stable revenue streamsto cover repayments.

2. Equity Funding????(Selling Shares to Investors or Venture Capitalists)

Definition

Equity funding involvesraising capital by selling sharesin the company to investors, such asprivate investors, venture capitalists, or the stock market.

✅Key Characteristics:

No repayment obligations, but shareholders expect areturn on investment (ROI).

Investorsgain partial ownershipand may influence business decisions.

Funding amount depends on the company’svaluation and investor interest.

????Example:XYZ sells20% of its shares to a private investor for £3 million, which funds new production lines.

Advantages of Equity Funding

✔No Repayment Obligation– Reduces financial burden on cash flow.✔Access to Large Capital– Easier to raise significant funds for expansion.✔Attracts Strategic Investors– Investors may provide expertise and industry connections.✔Spreads Business Risk– Losses are shared with investors, reducing pressure on XYZ.

Disadvantages of Equity Funding

❌Loss of Ownership & Control– Investors gain a say in company decisions.❌Profit Sharing– Dividends or profit-sharing reduce earnings for existing owners.❌Longer Decision-Making Process– Raising equity capital takes time due to negotiations and regulatory compliance.❌Dilution of Shares– Selling shares reduces the founder’s ownership percentage.

????Best for:Companies needinglarge funding amounts with less repayment pressure, but willing toshare ownership and decision-making.

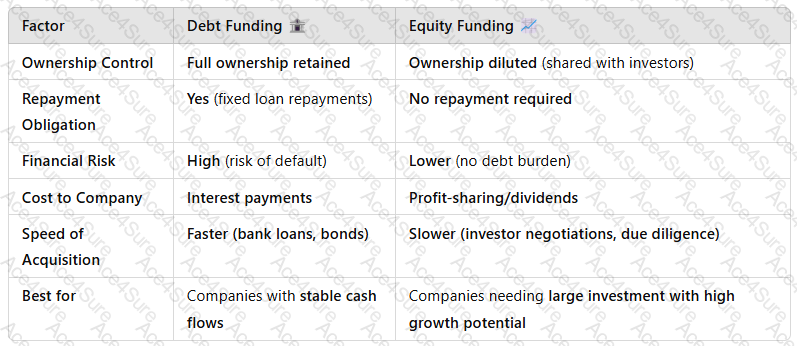

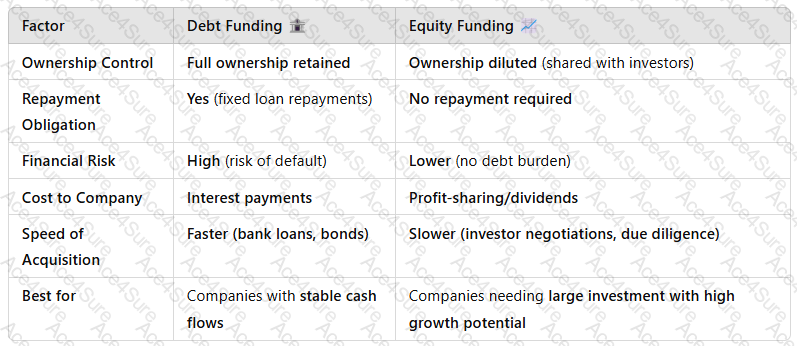

3. Comparison: Debt vs. Equity Funding

A screenshot of a computer screen

Description automatically generated

A screenshot of a computer screen

Description automatically generated

Key Takeaway:The choice betweendebt and equity fundingdepends on XYZ’srisk tolerance, cash flow stability, and long-term growth strategy.

4. Conclusion & Recommendation

Bothdebt funding and equity fundingoffer advantages and risks for XYZ’s expansion.

✅Debt fundingis ideal if XYZ wants toretain ownership and has stable revenueto cover loan repayments.✅Equity fundingis better if XYZ seekslarger investments, strategic expertise, and reduced financial risk.

????Recommended Approach:Ahybrid strategy, combiningdebt for short-term capital needsandequity for long-term growth, can providefinancial flexibility while minimizing risks.

A screenshot of a computer screen

Description automatically generated

A screenshot of a computer screen

Description automatically generated