Mergers vs. Acquisitions: Drivers, Risks, and Comparison to Organic Growth

Introduction

Businesses seeking growth can expand throughmergers and acquisitions (M&A)or byorganic development. Mergers and acquisitions involveexternal growth strategies, where companies combine forces or take over another business, whereas organic growth occursinternally through investment in operations, R&D, and market expansion.

While M&A strategies providerapid expansion and competitive advantages, they also carryintegration risks and financial complexitiescompared to organic growth.

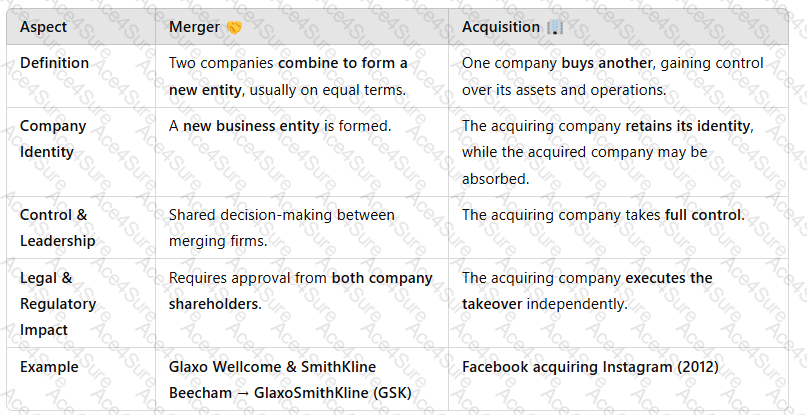

1. Difference Between a Merger and an Acquisition

A screenshot of a computer

Description automatically generated

A screenshot of a computer

Description automatically generated

Key Takeaway:Mergers are usuallycollaborative, while acquisitions involveone company dominating another.

2. Main Drivers of Mergers & Acquisitions (M&A)????

1. Market Expansion & Faster Growth

✅Providesimmediate accessto new markets, customers, and geographies.✅Faster than organic growth, allowing firms toscale operations quickly.

????Example:Amazon’s acquisition of Whole Foodsgave it an instant presence in the grocerysector.

2. Cost Synergies & Efficiency Gains

✅Reducesduplication of functions(e.g., shared IT, supply chain).✅Achieveseconomies of scale, lowering operating costs.

????Example:Disney’s acquisition of 21st Century Foxreduced production costs by consolidating media assets.

3. Competitive Advantage & Market Power

✅Eliminates competition by absorbingrival firms.✅Strengthensbargaining power over suppliers and distributors.

????Example:Google acquiring YouTuberemoved a major competitor in the video-sharing industry.

4. Access to New Technology & Innovation

✅Fast-tracksadoption of emerging technologies.✅Avoids lengthyin-house R&D developmentcycles.

????Example:Microsoft’s acquisition of LinkedIngave it access to AI-driven professional networking tools.

3. Risks of Mergers & Acquisitions⚠️

1. Cultural & Operational Integration Challenges

❌Employees from different companies mayresist integration, leading to conflicts.❌Different corporate culturesmay result in productivity loss.

????Example:TheDaimler-Chrysler merger faileddue to cultural clashes between German and American management styles.

2. High Financial Costs & Debt Risks

❌Acquiring companiesoften take on large amounts of debt.❌M&A dealsmay overvalue the target company, leading to losses.

????Example:AOL’s acquisition of Time Warner($165 billion) resulted inhuge financial lossesdue to overvaluation.

3. Regulatory and Legal Barriers

❌Government regulators mayblock mergers due to monopoly concerns.❌Legal challenges maydelay or cancel deals.

????Example:TheEU blocked Siemens and Alstom’s rail mergerdue to competition concerns.

4. Disruption to Core Business

❌Management focus on M&A candistract from existing operations.❌Post-merger integration complexitiescan lead to delays and inefficiencies.

????Example:HP’s acquisition of Compaqresulted in years of internal restructuring, impacting performance.

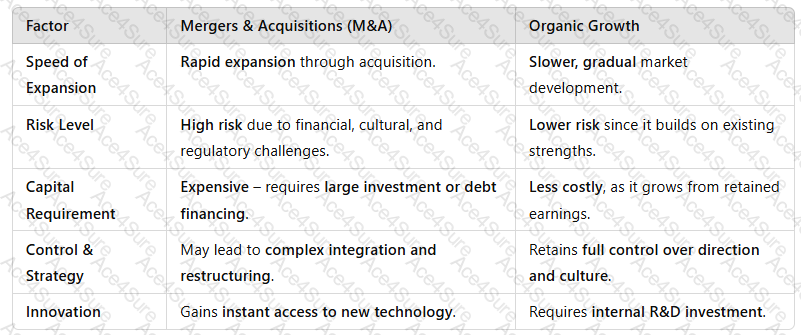

4. Comparison: M&A vs. Organic Growth

A screenshot of a computer

Description automatically generated

A screenshot of a computer

Description automatically generated

Key Takeaway:M&A providesfast expansionbut comes withhigher risks, whereas organic growth isslower but more sustainable.

5. Conclusion

Mergers and acquisitions offera fast-track to market leadership, providinggrowth, cost synergies, and competitive advantages. However, they also carrysignificant financial, cultural, and regulatory riskscompared to organic growth.

✅Best for:Companies needingrapid expansion, technology access, or competitive positioning.❌Risky when:Poor cultural integration, excessive debt, or regulatory obstacles arise.

Businesses mustcarefully assess strategic fit, financial feasibility, and post-merger integration plansbefore choosing M&A as a growth strategy.