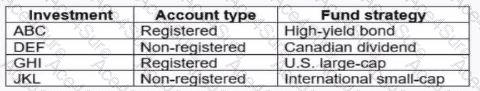

The correct answer is A. JKL, the non-registered international small-cap fund, because it is most likely to generate unexpected and fully taxable distributions at year-end. The Investment Funds in Canada course explains that mutual funds held in non-registered accounts are subject to taxation on distributions, even if the investor does not sell the fund. These distributions may include interest income, foreign income, dividends, and capital gains.

International equity funds typically generate foreign-source income, which does not qualify for the Canadian dividend tax credit and is therefore fully taxable at the investor’s marginal tax rate. In addition, international small-cap funds tend to have higher portfolio turnover, increasing the likelihood of realizing capital gains inside the fund. The CIFC curriculum emphasizes that “capital gains distributions are taxable to investors even when automatically reinvested,” making them a common source of unexpected taxes.

By contrast, DEF (Canadian dividend fund in a non-registered account) benefits from the dividend tax credit, reducing its tax burden. ABC and GHI are held in registered accounts, where income and capital gains are either tax-deferred or tax-sheltered, meaning no current tax consequences apply.

The course specifically warns that purchasing funds late in the year in non-registered accounts can result in “buying a taxable distribution”, especially with international equity funds.