AAFM GLO_CWM_LVL_1 Question Answer

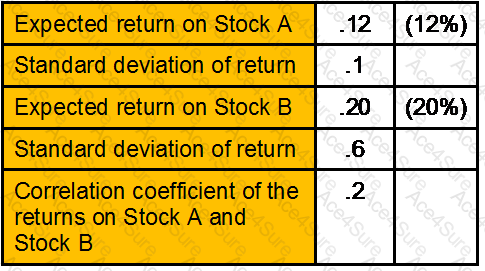

Given the following information:

What is the expected return and standard deviation of the portfolio if 50% of funds invested in each stock? What would be the impact if the correlation coefficient were 0.6 instead of 0.2?

Next

Previous