CIMA F3 Question Answer

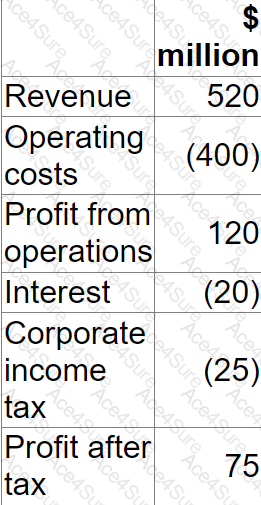

The table below shows the forecast for a company's next financial year:

The forecast incorporates the following assumptions:

• 25% of operating costs are variable

• Debt finance comprises a $400 million fixed rate loan at 5%

• Corporate income tax is paid at 25%

The company plans to do the following next year from the forecast earnings on the assumption that earnings will be equivalent to free cash flow:

• Pay a total dividend of $20 million

• Invest $40 million in new projects

What is the maximum % reduction in operating activity that could occur next year before the company's dividend and investment plans are affected?

Give your answer to the nearest 0.1%.