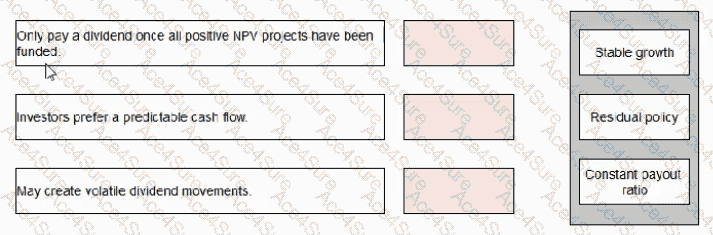

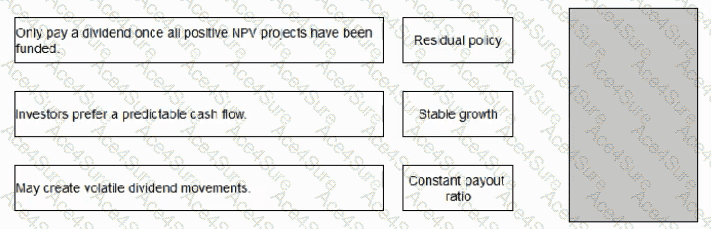

“Only pay a dividend once all positive NPV projects have been funded.” → Residual policy

Under a residual dividend policy, the firm first uses earnings to finance all projects with a positive NPV.

Whatever profit is left over (the “residual”) may be paid out as dividends.

So dividends are not the target; investment in value-adding projects is. That’s exactly what the statement describes.

“Investors prefer a predictable cash flow.” → Stable growth

A stable (or steadily growing) dividend policy aims to provide shareholders with a smooth, predictable stream of dividends.

Even if earnings are volatile, management tries to keep dividends level or with a modest regular increase.

This appeals to investors who value certainty of income, which is what the statement is referring to.

“May create volatile dividend movements.” → Constant payout ratio

With a constant payout ratio, the company always pays the same percentage of earnings as dividends (e.g. 40% of earnings every year).

If earnings go up and down, the dividend per share will also go up and down proportionally.

That leads to volatile dividend movements, which is exactly what the statement says.

So the final mapping is:

Residual policy → “Only pay a dividend once all positive NPV projects have been funded.”

Stable growth → “Investors prefer a predictable cash flow.”

Constant payout ratio → “May create volatile dividend movements.”