CIMA F3 Question Answer

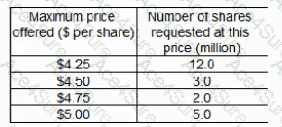

Company C invests heavily in Research and Development an need to raise $45 million to finance future projects. It has decided to use equity finance raised by a tender offer, The following tender offers have been received from potential investors:

Company C wishes to select an offer price that will project shareholders from a significant dilution of control but still raise the required amount of finance.

What offer price should Company C’s select?