CIMA F3 Question Answer

A company is considering taking out $10.000,000 of floating rate bank borrowings to finance a new project. The current rate available to the company on floating rate barrowings is 8%. The borrowings contain a covenant based on an interested cover of5times.

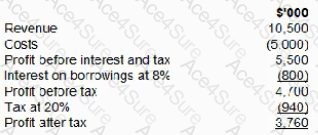

The project is expected to generate the following results:

At what interest rate on the floating rate borrowings is the bank covenant first breached?