CIMA F3 Question Answer

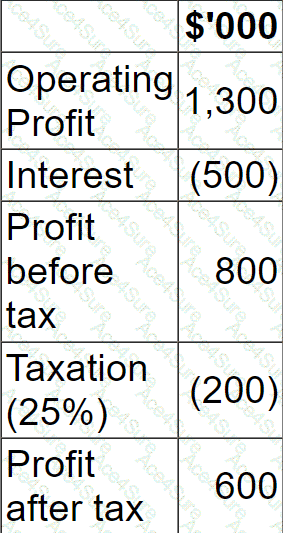

A company has forecast the following results for the next financial year:

The following is also relevant:

• Profit after tax for the year can be assumed to be equivalent to free cash flow for the year.

• Debt finance comprises a $10 million floating rate loan which currently carries an interest rate of 5%.

• $400,000 investment in non-current assets is required to achieve required growth, all of which is to financed from next year's free cash flow.

• The company plans to pay a dividend of $150,000 next year, financed from next year's free cash flow.

The company is concerned that interest rates could rise next year to 6% which could then affect their investment plans.

If interest rates were to rise to 6% and the company wishes to maintain its dividend amount, the planned investment expenditure will decrease by: