CIMA F2 Question Answer

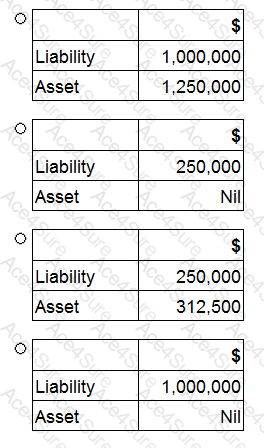

The following information relates to DEF for the year ended 31 December 20X7:

• Property, plant and equipment has a carrying value of $3,500,000 and a tax written down value of $2,500,000.

• There are unused tax losses to carry forward of $1,250,000. These tax losses have arisen due to poor trading conditions which are not expected to improve in the foreseeable future.

• The corporate income tax rate is 25%.

In accordance with IAS 12 Income Taxes, the financial statements of DEF for the year ended 31 December 20X7 would recognise deferred tax balances of: