AAFM CWM_LEVEL_2 Question Answer

Section C (4 Mark)

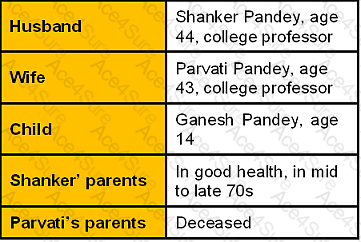

Personal Data

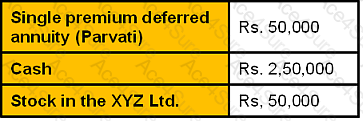

Financial Data

Shanker and Parvati Pandey have the following assets at fair market value (FMV):

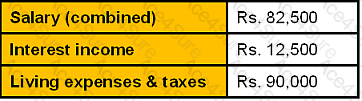

Their simplified income statement is presented as follows:

They have no liabilities and no company-sponsored retirement plans.

They have no wills and they live in a non-community property state.

Shankers’ parents can meet all current expenses from current cash flow but have very limited reserve funds

Other Relevant Data

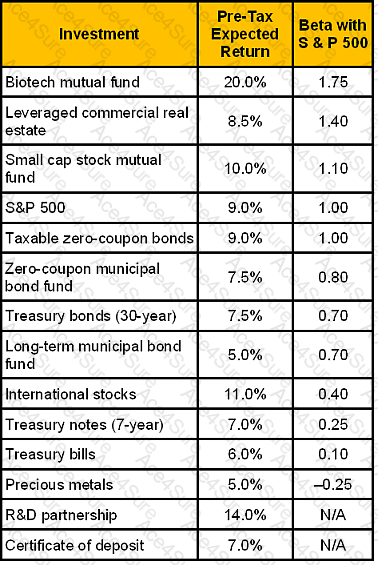

●They are inexperienced investors, but they are willing to take reasonable and normal investment risk if appropriate, but they do not wish to invest aggressively.

●Both Shanker and Parvati have purchased term life insurance policies with Rs. 250,000 death benefit on each; they own their own policies, and Ganesh is the contingent beneficiary on both policies.

●Shanker is the primary beneficiary of Parvati’s single premium deferred annuity; Ganesh is the contingent beneficiary.

●You have found their disability insurance inadequate. The Pandey have indicated they could fit your proposed Rs. 3500 annual premium for an adequate policy into their living expenses.

●You have reviewed their auto, homeowner’s, liability, and life insurance and found their policies adequate. Shanker and Parvati are responsible for their medical expenses.

●Ganesh is an intelligent high school student who earns scholarship of Rs. 2,000 annually and has a Rs. 500 in savings account.

●The “cash” is invested in a variety of money market funds and insured savings accounts.

●They do not plan additional children and they have no other dependents.

●The Pandey currently can save Rs. 5,000 per year out of current salary and can continue to do so (in inflation-adjusted Rupees) until they retire in 20 years. This savings rate assumes that all planned asset acquisition and replacements are paid out of income before savings (except the three goals as per below.

Goals (in order of priority)

1.College education for Ganesh. They expect to spend a total of Rs. 5,00,000 (Present value) for his entire education.

2.Retirement in 20 years which maximizes their standard of living at retirement.

3.Parvati and Shanker plan to take 6 months off from work (“sabbatical”) in 4 years for travel and research and to spend Rs. 1,50,000.

Economic Environment

The economy has been in a period of modest economic growth for about 2 years. Inflation, as measured by the CPI, was at a 4.9% annual rate over the last year. Ninety-day T-bill rates are currently 6%, while the yield to maturity on 20-year government bonds is 7.5%. Most forecasts call for little change in these conditions over the short and long term.

Assumptions provided by Wealth Manager