AAFM CWM_LEVEL_2 Question Answer

Section C (4 Mark)

Mr. Vinay, aged 36 years is working in a company, at a managerial level, and has an income of Rs. 40,000 p.m. comprising of Basic salary and DA as on 31/03/2008. His other allowances amount to Rs. 18,000 p.m. He would retire at the age of 60 years. His wife Reena, aged 32 years, is working in a High School and has a post-tax income of Rs. 2,76,000 per annum. Mr. and Mrs. Vinay have two daughter Deepika, aged 10 years and Rekha, aged 5 years.

Mr. Vinay, aged 36 years is working in a company, at a managerial level, and has an income of Rs. 40,000 p.m. comprising of Basic salary and DA as on 31/03/2008. His other allowances amount to Rs. 18,000 p.m. He would retire at the age of 60 years. His wife Reena, aged 32 years, is working in a High School and has a post-tax income of Rs. 2,76,000 per annum. Mr. and Mrs. Vinay have two daughter Deepika, aged 10 years and Rekha, aged 5 years.

Mr. Vinay’s father died of heart attack, 5 months back, at the age of 72 years, leaving a house (Value as on date Rs. 30 lakh) in which Vinay is staying at present and other assets worth Rs. 20 lakh (shares of large cap companies worth Rs. 10 lakh, Fixed deposit in post office of Rs. 5 lakh and Bank FD of Rs. 5 lakh) in Vinay’s mother’s name. His mother 63 years old is disabled and fully dependent on Vinay, he being the only child of his parents. Vinay has to keep an attendant for his mother, round the clock.

The Assets of the Couple are:

1.Cash in HandRs. 18,000

2.Bank balanceRs. 40,000 (Vinay) Rs. 25,000 (Reena)

3.JewelleryRs. 400000 (Reena)

4.Money Market Mutual FundRs. 3,00,000 (Vinay)

5.Shares

?ICICI Bank 200 shares bought at Rs. 1000 per share,

?Infosys 150 shares bought at Rs. 1700 per share

?Reliance Communication 350 shares bought at Rs. 350 share.

6.Debt oriented mutual FundsRs. 2,00,000

7.PPFRs. 5,00,000 (Vinay), Rs. 4,00,000 (Reena)

8.House in the joint name of Vinay and Reena with 50% ownership of each. This house has two floors and is let out for Rs. 9,000 pm for each of the floors. Present value of this house is Rs. 60,00,000.

Vinay and Reena had taken a housing loan of Rs. 15,00,000 each. Of this Rs. 10,00,000 is pending on each name. They are presently paying an EMI of Rs. 20,000 each, Rate of interest being 10.75% p.a.

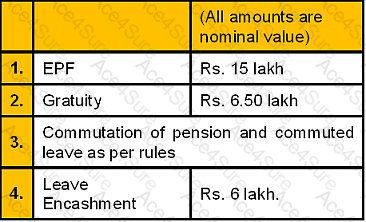

The Retirement Benefits of Vinay after 15 years hence, are expected to be as follows:

Vinay has taken a term insurance of Rs. 30 lakh for 20 years, which is expiring 5 years from now. He has no other insurance. Vinay’s monthly household/ living expenses are Rs. 50,000. This excludes EMI on loans but includes all other expenses including expenses on his mother’s care.

Vinay expects Deepika to get married 12 years hence for which likely expenditures in today’s term is 15 lakh.

Vinay’s salary is likely to grow at 7% pa and Reena’s salary is likely to grow at 6% p.a. Risk free rate of interest is 8% pa and inflation is 6% p.a. Long term growth on Equity/Equity based MF is taken as 15% p.a.