Theintrinsic valueof a warrant is calculated as the difference between the current market price of the common share and the exercise price of the warrant, provided the market price of the share is higher than the exercise price.

Intrinsic Value=Market Price of Common Share−Exercise Price of Warrant\text{Intrinsic Value} = \text{Market Price of Common Share} - \text{Exercise Price of Warrant}Intrinsic Value=Market Price of Common Share−Exercise Price of Warrant

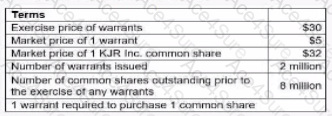

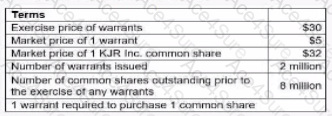

Using the values provided:

Market Price of 1 KJR Inc. Common Share= $32

Exercise Price of Warrants= $30

Intrinsic Value=32−30=2\text{Intrinsic Value} = 32 - 30 = 2Intrinsic Value=32−30=2

Since the market price of the share is greater than the exercise price, the intrinsic value is$2.

Explanation of Incorrect Options:

Option A ($0):This would be correct if the exercise price were greater than or equal to the market price of the common share.

Option B ($5):This incorrectly includes the market price of the warrant ($5), which is irrelevant to intrinsic value calculation.

Option D ($3):This is not derived from the given data and calculations.

References:

Canadian Securities Course (CSC), Volume 1, Chapter 8: Equity Securities – Common and Preferred Shares. Discussion on warrants, including intrinsic value calculations.