Step-by-step Calculation:

Step 1: Calculate current variable cost per unit:

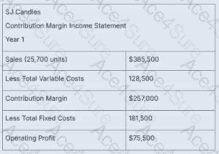

Variable cost per unit = $128,500 / 25,700 = $5.00

Step 2: Increase variable cost per unit by 10%:

New variable cost per unit = $5.00 × 1.10 = $5.50

Step 3: Determine sales price per unit:

Sales per unit = $385,500 / 25,700 = $15.00

Step 4: Contribution margin per unit for year 2:

= $15.00 − $5.50 = $9.50

Step 5: Use CVP formula to solve for required units to achieve same profit:

Required Units = (Fixed Costs + Target Profit) / Contribution Margin per Unit

= ($181,500 + $75,500) / $9.50

= $257,000 / $9.50 = 27,053 units (rounded)

Step 6: Compute required sales in dollars:

= 27,053 units × $15.00 = $405,795 ≈ $405,789

Answer: C. $405,789

[Reference:Saylor Academy, BUS105: Managerial AccountingUnit 5.2 – Cost-Volume-Profit Analysishttps://learn.saylor.org/mod/book/view.php?id=28820&chapterid=6710, —]